Heuristics is the second-basic terminology in the dictionary of Behavioural science, after Biases.

Heuristics (pronunciation: Hyoo-ristiks) is derived from the Greek word meaning ‘to find or discover’. In finance, Heuristics means a quick and flexible problem-solving method to arrive at good-enough conclusions in a way that influences one’s decision or judgement. We then try and rationalise how good our judgements/decisions are by inculpating the case and time frame presented to us as complex and limited.

Really, how good are our judgements?

We as humans are judgemental and opinionated in nature and usually irrational but rational enough to know that. We make numerous decisions in a day, both trivial and non-trivial ones. Out of which, very few involves conscious efforts to think like rational beings. But otherwise, we are typically irrational.

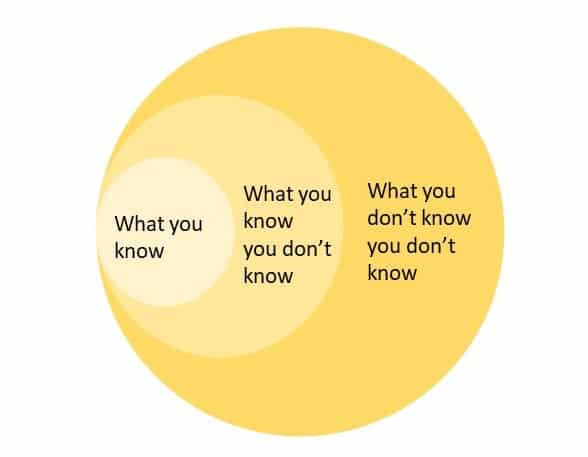

We think we know and, we continue making decisions with very little knowledge. Although, what we know and what we need to know (or what we do not know) are two edges of the same sword. More often than not, our decisions are empirical because it saves time and mental energy required to do actual research. Optimistically, we are accumulating cognitive assets for more complex planning and problem-solving endeavours. But here is a question for you to reflect on: How can you sharpen your decision-making skills without putting them to frequent use? In my view, cognitive assets have to be kept in constant check that it becomes a basic reflex.

There is no one decision that is perfectly suitable for all kinds of similar situations or people. When you follow one size fits all approach, it is almost equivalent to being indecisive by letting the situation take control of you. That is when you become predictably irrational to those whose thinking and decision-making game is strong.

Heuristics in Behavioural Finance

Heuristics can very well be an act of choosing from the food menu (pizza or focaccia) or an outfit from your wardrobe (denim or cotton). And Heuristics is an efficient approach because these decisions are chosen best through intuition based on what we like and depending on our mood. It also reduces our cognitive load of over-analysing things and focuses mainly on self-satisfaction.

Richard Feynman, a famous American theoretical physicist, who is one of the fastest thinking and most creative theorists of his generation, rightly said that ‘The first principle is that you must not fool yourself and you are the easiest person to fool’. It is very much true in the role that Heuristics play in Behavioural finance.

As investors, we jump from one stock to another depending on what is hot in the news and is on the stock recommendations list. We also subconsciously build random trust in the companies that we can quickly recall. These are some of the examples of Availability heuristics.

The bigger problem is when finance professionals use their intuition to speed up analysis and make investment decisions. It is in the nature of every human being to invariably look for shortcuts that are trigger-worthy, dramatic events and someone (anyone actually!) to acknowledge our impending decision. We are all intuitive Statisticians that way.

Here are few types of heuristics that Daniel Kahneman quite frequently points out in his research papers that are very pertinent to financial markets:

- Availability heuristics

- Anchoring and adjustment heuristics

- Representative heuristics

Watch out for this space to learn more about the abovementioned heuristics in our upcoming articles.

For now, it will be beneficial to keep in mind the basic thumb rules before making investment decisions:

- Do not fall prey to information that is easy to obtain

- Search for hard-to-get information

- Always look for the non-dramatic events

- Learn the errors of commission but most importantly, errors of Omission as well

- Associate yourself with people who think differently and question your belief system all the time

- Introspect all of the above from time and again.

These are some great ways to start building healthy cognitive dissonance between your adaptive mind and preconceived notions. Lastly, perform small tasks to identify your mental shortcuts to become cognizant of your behavioural model.