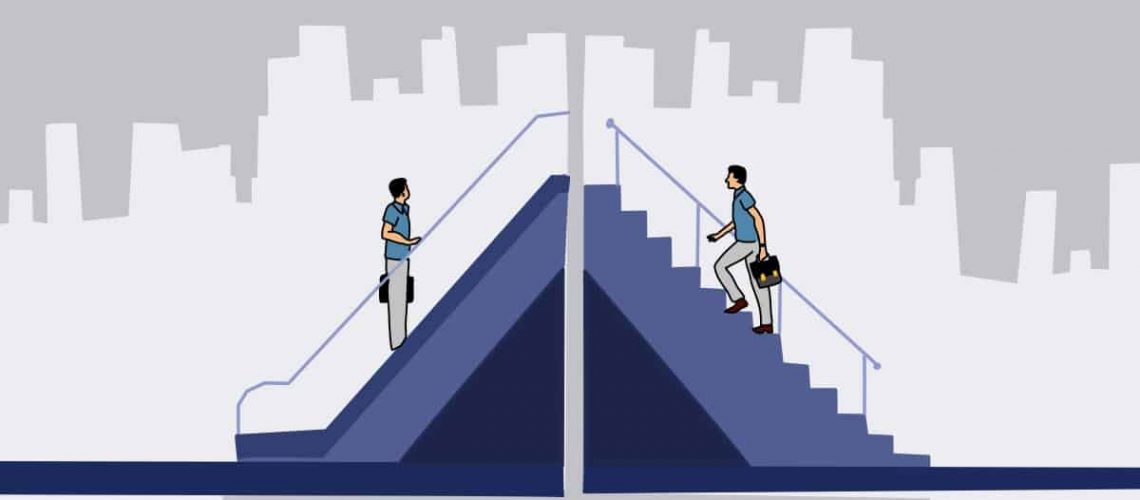

The collocation of Active and Passive can be observed and used colloquially more often that you don’t need any elaborate explaining to do on the topic. However, there are few grey areas to the juxtaposed word pair that needs to be emphasised. In the investing world, Active and Passive management of portfolios simply indicate the path you decide to manage your assets; precisely, an investing strategy.

Actively managed portfolios are created, monitored and managed by Portfolio managers whose aim is to beat the benchmark (synonym: stock market index; e.g. Dow Jones Industrial Average). An index, primarily, is a means to provide statistical measure and understanding of various data (such as inflation, consumer confidence, changing demands and preferences) related to economy and financial markets. While passive management of portfolios simply means that you can save yourself from the whole trouble of understanding the nuances of active management by following an investment strategy which replicates a particular index.

![]() Passive management involves little to no analysis of individual companies. Research and analysis play a major role in identifying buy/sell opportunities that (are expected to) provide alpha returns in Active portfolios. As a result, active fund managers trade often driving home an important point, that frequent-analysis, trading and reporting is an expensive affair.

Passive management involves little to no analysis of individual companies. Research and analysis play a major role in identifying buy/sell opportunities that (are expected to) provide alpha returns in Active portfolios. As a result, active fund managers trade often driving home an important point, that frequent-analysis, trading and reporting is an expensive affair.

Active portfolios are, often borne to risks, under the pretext of ‘beating the performance of a benchmark’. Most of the actively managed portfolios have reference benchmark acting as a yardstick to compare metrics like performance and risk. But it is also important to note that not all portfolios are benchmark-aware. Some are benchmark agnostic as well.

Index funds, on other hand, are usually constructed (or mimicked) against the weights of a chosen benchmark. Their core belief comes from the Efficient market hypothesis that prices in the market, at some point, do reflect all available information and that there is no way that one can ‘beat the market’. For the dependency that index funds have they lose the flexibility that active portfolios have in trading and stock-picking.

Now that you have a high-level understanding of active and passive management strategies, here are few must-knows before you identify yourself as an Active or Passive investor:

Actively managed portfolios do not guarantee outperformance. They usually charge higher fees than the other and do not necessarily look for an unpopular, small-cap gem business, all the time.

Passively managed portfolios are not always low-cost, tax-efficient, diversified funds. Indexes most certainly do not represent all the available information in the markets, all the time. Most importantly, index funds and ETFs are not the same.

So now tell me, do you really want to restrict yourself to one strategy while you very well can experience investing in either of them? What you can rather do is find the right balance and ration your portfolio by assigning appropriate weights to assets based on your risk-reward ratio. And in the process, you can most certainly do the following:

- Repeated mantra: always Diversify!

- Try focusing on the long-term: The big, ultimate picture!

- Understand what’s packaged as the Expense ratio: Look for low-cost funds!

- Decide on what you are willing to forego: Tax-efficiency and Alpha generation are not always well acquainted with one another!

- Ensure you make time to understand what is truly going on with them businesses and stocks.

- And of course, look out for Biases always!

Finally, remove “What are you?” aspect from the title of this article and reflect upon the survey you just took (What a bummer if you haven’t done it yet!… But it’s okay to do the reverse too, so click here) to understand the characteristics of Active and passive investors better.