Most times our Income statements are nothing but long-drawn-out tax laws broken down in layman terms. Sometimes they get tricky with words like ‘Marginal Relief’.

Read on to acquaint yourself with this term!

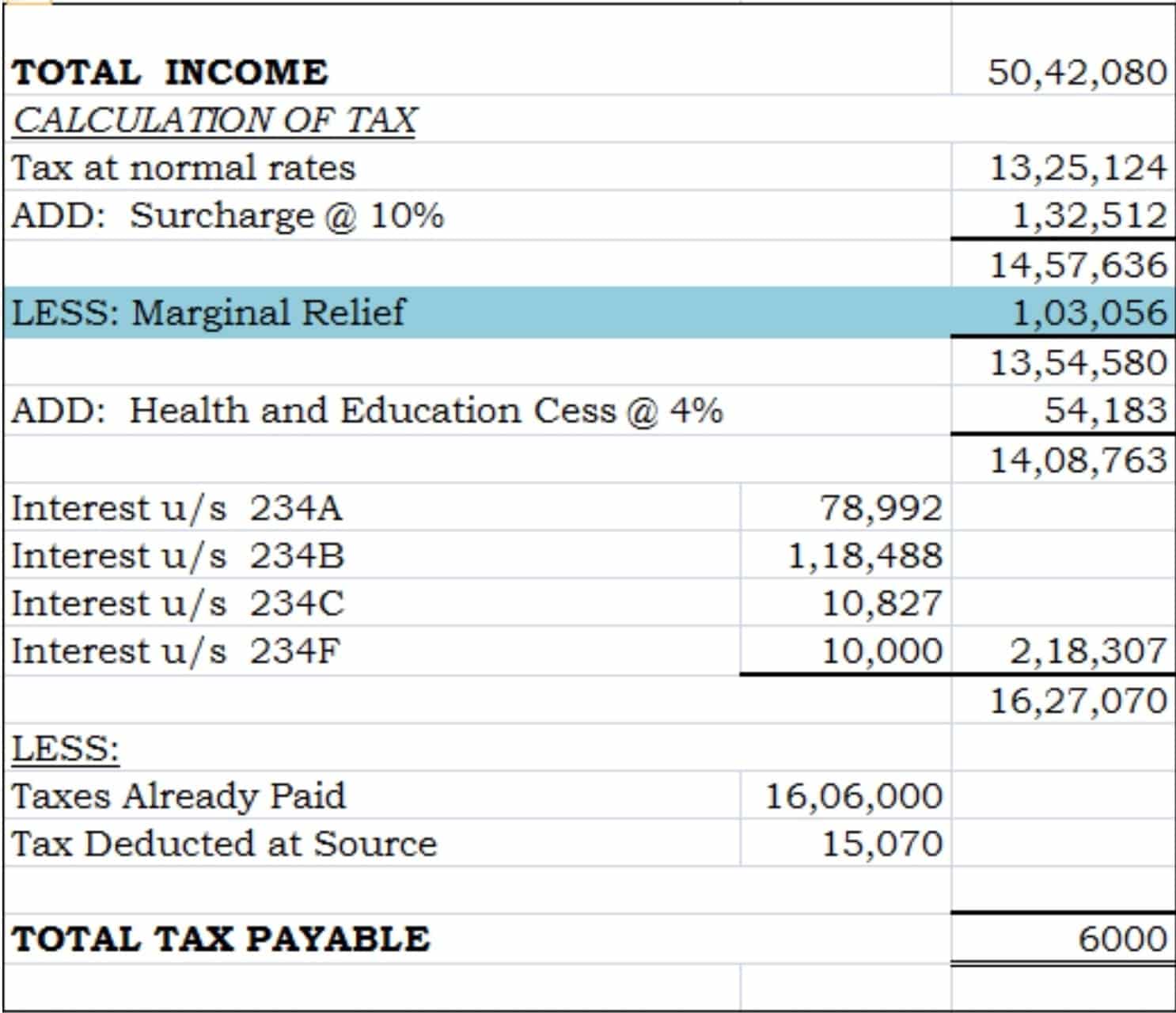

One of my clients had a query on this. I went through his Income Statement.

He said,’While it’s not too complicated to understand what Surcharges, Cesses and Interests are, Marginal Relief, however, is difficult to understand’.

Because, it appeared for the first time in his tax calculations and was reducing his tax liability by a significant sum. He was now all the more curious to know.

These are some of the questions that I addressed to him on this topic, which you might also be interested in knowing, if it has not happened to you already-

The basic: What is Marginal Relief?

A provision in the tax laws to reduce the burden of the taxpayer in paying Surcharge (a tax on tax for high-income groups) at the rates applicable to it, when the Total income exceeds certain, specified limits.

Thus, Marginal relief provisions are applicable when a surcharge is payable by the assessee. It comes as a relief, especially to those taxpayers whose incomes are subject to surcharge on account of their total income figure being just marginally higher than the limits specified.

Applicable Surcharge rates

| Assessee status |

Total income limits |

% Surcharge |

| Individual (resident or non-resident) or HUF or AOP or BOI or any other artificial juridical person |

50 Lakhs < Total Income ≤ 1 Crore |

10% |

|

1 Crore < Total Income ≤ 2 Crores |

15% |

|

|

2 Crores < Total Income ≤ 5 Crores |

25% |

|

|

5 Crores < Total Income ≤ 10 Crores |

37% |

|

|

Total Income >10 Crores |

37% |

|

| Firm/LLP/Local authorities/Co-operative Society |

Total Income >1 Crore |

12% |

| Domestic Company |

1 Crore < Total Income ≤ 10 Crores |

7% |

|

Total Income >10 Crores |

12% |

|

| Foreign Company |

1 Crore < Total Income ≤ 10 Crores |

2% |

|

Total Income >10 Crores |

5% |

How is it calculated?

Simplifying the elaborate provision of law, the figure is arrived at by following the steps below.

Step 1: Calculate Income-tax (including Surcharge) on Total income at normal rates.

In this case, it is Rs.14,57,636.

Step 2: Once again, calculate Income tax on the amount of income below the specified limit, exceeding which it would be subject to Surcharge at applicable rates.

Here: Tax at normal rates on Rs.50,00,000 (exceeding which Surcharge has been levied at 10% in case of my client) which is Rs.13,12,500.

Step 3: Add the amount of Total income exceeding the limit specified in Step 2 (Rs.50,00,000) to the tax amount calculated in Step 2.

(i.e.) [13,12,500+(50,42,080-50,00,000)] Rs.13,54,580.

Step 4: Marginal relief as the excess of Step 1 over Step 3.

(i.e.) 14,57,636 – 13,54,580 = Rs.1,03,056.

Here, the client still had his doubts. He quickly turns to his income statement from the previous year and points to his total income figure of Rs.62,10,620 and tries to understand why no such marginal relief was availed during that year despite paying a surcharge of 10%.

Really, sharp-witted!

Now, if you must, go back and read Step 4 again.

Marginal relief is allowable ‘only’ when the Step 1 figure exceeds the Step 3 figure, which in this case were Rs.18,43,255 and Rs.25,23,120 respectively.

So, no such Marginal relief was applicable. Now assuming that you understood how Marginal relief works, here are some important things to note.

Key takeaways:

- Since Marginal relief is allowable only when paying Surcharge on higher-income earned in the relevant financial year, it is not allowable with respect to the Cess levied. Hence, Cess is calculated on the amount arrived at after providing for Marginal relief.

- Marginal relief is based on the justification that the increased tax amount shouldn’t exceed increased amount of income.

Here,

- The amount earned over 50 Lakhs is 42,080.

- The amount of tax payable including the Surcharge on the actual Total income of Rs.5,42,080 is Rs.14, 57,636. Had the total income been 50 Lakhs, the tax that would have been payable would only be Rs.13, 12, 500 (No surcharge applicable as income doesn’t exceed 50Lakhs). So, the excess tax that arises is 14,57,636 – 13,12,500 = 1,45,136.

Evidently, an excess income of Rs.42,080 is subject to excess tax of Rs.1,45,136, which is clearly inordinate.

Hence, Marginal relief allowed as the difference between amount of excess tax and excess income is Rs.1,03,056. This is just another way of arriving at this number.