In this article, we will discuss one of the popular speculative investment strategies that some traders implement based on their intuitive preferences rather than evaluating the actual value of business or company’s share price. They usually are contrarians to fundamental analysis and value investors.

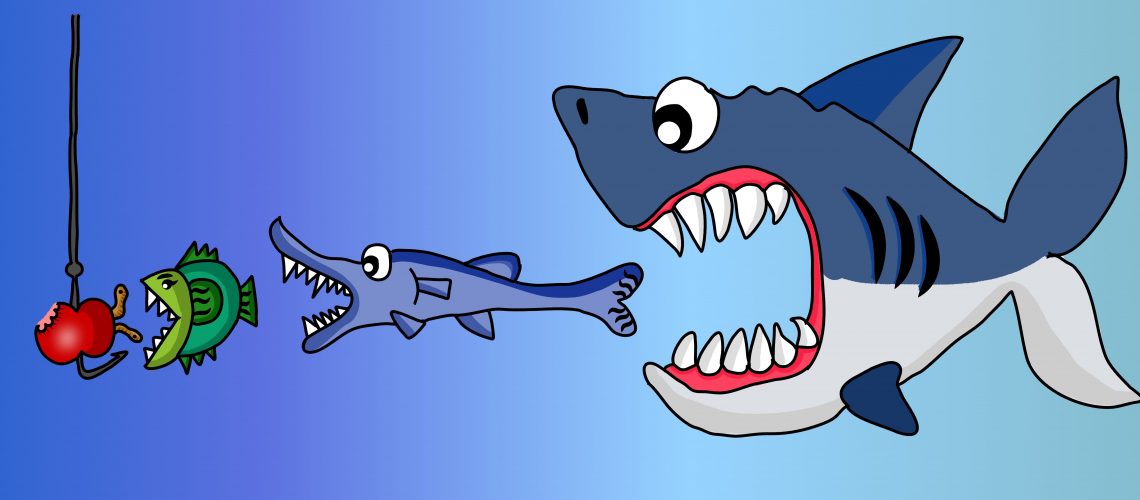

The Greater fools! I know it is quite ghastly to call anyone that. But this is more so calling out on the cognitive bias that we all tend to have while going for a business/company/stock/product/service based on the Halo effect or, just a plain belief that there will be a greater fool (than you) to buy it from you, over and above the price you paid. The greater fool theory is quite familiar among market participants because this was originally formed to address ‘the Market bubble’.

Due to various reasons, a particular stock becomes “hot” (definition: overvalued) and before you realize, most of them are buying large chunks of shares as an outcome of the herd mentality. Some of the popular scenarios are:

- The company is seen on the news repetitively and in a good light.

- Some business becomes popular because they are new and their ad campaigns are great.

- The stock sets a new trend and you buy a few shares just to be part of some cool club.

- The company seems to be doing something great with the products and services they offer and people are talking about it.

Simply put, the stock becomes hot and famous in a very short period. The share price rallies because everyone is buying. The value of shares rises dramatically; way beyond its fundamental value. The assets of the company increase through these skyrocketing investments. Voila, there is a Market bubble and some of us are a part of it: when the bubble bursts, you are losing all or most of your investments as well.

What started as a wave of optimism and enthusiasm for you (: market participants) might create a ripple effect across the industry, leading the entire market to crash. This then makes it to history as a Doom’s day to financial markets, an economic event that washed down most of our hard-earned money due to the outbursts of irrationality.

Way before ‘The Greater Fool Theory’ was explained, John Maynard Keynes, a popular economist explained this concept differently through what he called has “Keynesian Beauty contest”. In which, he made this concept so simple by explaining how a jury is applauded for choosing the most popular participant in the beauty contest as a winner than who, one personally finds attractive.

“It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligence to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.”

– Keynes’ General Theory of Employment, Interest and Money, 1936

In comparison, ‘Popular opinion’ denotes the hype that is created in the market that led to an overpriced stock and ‘Personal’ or ‘generally unpopular opinion’ speaks of the intrinsic value of the stock to which it will always revert to, if not falling way below during the adversely dramatic event. The returns often revert to its original value (average price) after having a sharp decline, especially if the shares are over-valued. It is called mean-reverting and we will discuss more on this topic in our upcoming articles.

The Greater fool theory is a corollary of herd mentality and in fact, a risky strategy which no long-term, value investors will prefer while managing their portfolios. Because this is not only catastrophic but also time-, capital- and resource-intensive if one were to choose this path.

It is eminent to understand this cognitive bias and the bigger picture of how speculative bubbles are formed because when it eventually bursts there is a large trade-off of assets for less or no value. US Mortgage crisis and the Dotcom Bubble are some of the popular examples of this theory. Selling an Art at the auction is an evergreen example of this theory but the only difference is, that buyer is mostly aware and are willing to pay the price as a means to maintaining certain social status.

In the purview of a greater fool, we tend to believe that there is an even greater fool to buy at a higher price and that, we can make profits by selling. As far as they are sold and money is not accumulated, in the bubble that is about to burst, you are not in the danger of losing all your assets. There will be no market misfits or the existence of greater fool theory if we were never affected by this mental shortcut.

On the flip side, when it comes to necessary goods, we are sometimes left with no choice but to buy the product for its inflated price even though we know that we are paying a higher price due to demand in the market. The economic landscape of supply and demand pushes the price to be on the higher end and vice-versa, based on the availability of resources.

How do you avoid paying ‘the foolish price’?

This theory is related to Game theory in which you speculate the willingness of other players (market participants, in this case) to win the game (to end up not being a greater fool). If the maximum amount that a buyer is willing to pay, is way above the intrinsic value of the asset then it is certain that you are paying the foolish price. Here are some ways to avoid:

- Stick to the fundamentals. Drawing the valuation for a company could be tedious but the outcome can certainly tell you if the excess capital is going into return-generating business operations in the long run.

- Numbers don’t lie. The audited financial information of the company is an accurate piece of information than your intuitive preferences.

- Resist temptation. Investing in stock because, it is popular, has inflated multiples (numbers are deceptive, in this scenario) or you just like the idea of owning a piece of that company makes you irrational and vulnerable to Herd mentality

- Beware of the purchasing frenzy. Investor enthusiasm might lead to over-investment attributing to the price surge and in turn, towards economic danger.

- Identify the market scenario. Follow the markets closely. If we are in a hyper-inflated situation, wait for the market correction to happen and be wary of the fact that markets can reverse in minutes.

All roads lead to one final mantra: Doing your own research is home to avoiding most of the heuristics and biases. It is also worth noting that, when you are losing money, there is always someone who is gaining that money and vice-versa. So, it is inevitable to focus on building investment strategies that are adaptable to constantly changing market environment.

14 Responses

I like looking through an article that can make people think. Also, thanks for allowing me to comment!

What’s up to all, I think every one is getting more from this web site, and your views are fastidious for new users.

Good day! I just would like to give you a huge thumbs up for the excellent info you have right here on this post. I will be coming back to your blog for more soon.

Thanks a lot for the blog post. Awesome.

It’s really a great and helpful piece of info.

I’m glad that you shared this helpful info with us. Please keep us informed like this.

Thanks for sharing.

Simply wish to say the frankness in your article is surprising.

Its not my first time to pay a quick visit this web page, i am browsing this web site dailly and get nice data from here daily.

Way cool! Some very valid points! I appreciate you penning this article and also the rest of the

site is very good.

Remarkable! Its really amazing post, I have got much clear idea concerning from this article.

Valuable content plus an easy to read layout. Your website earns the numerous supportive comments it has been accumulating.

Hello to every one, the contents present at this web page are actually remarkable for people experience, well, keep up the nice work fellows.

Everything is very open with a very clear clarification of the issues. It was definitely informative.

It is not my first time to visit this web page, i am browsing this site dailly and get nice information from here everyday.

An outstanding share! Ive just forwarded this onto a associate who has been conducting a little research upon this. And he actually bought me lunch clearly because I stumbled on it for him lol. fittingly allow me to reword this. Thanks for the meal!! But yeah, thanks for spending the period to discuss this matter here on your web page.