Does your investment portfolio reflect some kind of moral grounds and make reasonable returns as well? Before you answer that, let us try and understand what ESG means to Investment industry in the purview of various stakeholders like investors, regulators, portfolio managers, the board of any company and many others. I will also expose you to some basic vernacular that the ESG guys often use, in order to set the context unambiguously.

In simple terms, ESG issues are nothing but a result of an adverse impact caused to an economy (more so to entire livelihood, in this setting) due to improper utilisation of different resources like natural, human, social and financial capital. Although considered a global issue, there is no universal categorization of ESG issues yet. They differ based on the economic region, industry, company and business model.

Environmental, Social, Governance (ESG) investing

What started as mere shareholder activism in companies led to a strong emerging trend, pushing it to mainstream by breaking the speculation of ESG just being a fad. Some Portfolio managers (PMs) even began tilting investment portfolios to adjust against Sustainability metrics in order to create a value proposition that generates alpha, while also integrating ESG throughout portfolio analysis. Most Fund houses across the world quickly jumped on this ESG bandwagon. But, there are some hefty criticisms that are still going around on this branch of investing.

One of the first conversations on ESG was by the UN via Principles of Responsible investing (PRI) whose PRI assessments and Transparency reports, along with being their signatory, are well regarded in the portfolio management field. The idea was to create a globally sustainable investment universe by nurturing the idea of responsible investment (RI).

Why is ESG important to anyone?

Asset managers’ main aim is to create shareholder wealth. As investors, you trust them to do their job for which you pay a portion as fees too. With ESG in the picture now, does generating alpha goes to a toss? Or, is it really a shift from ‘wealth management’ towards ‘value creation’? Most of all, how do you measure them?

ESG thematics clearly fall under Value investing but it doesn’t mean it can not be measured. At the same time, not everything that can be counted counts and everything that counts can be counted. As an investor, it starts from what You believe in (i.e) your investment philosophy/investment purpose. And in a larger picture, Multiplying wealth is no more an isolated goal in investments.

Now of all times especially is ideal to quote the significance of investing in Sustainability of the future. Millions of lives lost to COVID reminded us that there is still a lot more room for development in Healthcare and infrastructure. Most of the government decisions, overwhelmed healthcare units and various other institutions almost grinded to halt because of this ‘never have I ever’ imagined situation. It not only highlights how unprepared we are to things that we have never seen in life but also indicates a massively lurking Governance issue at an economic level. George Floyd’s tragic story is a reminder of mixed sentiments when it comes to racial discrimination and is a classic Social issue.

From Volkswagen’s green scandal to Facebook’s data privacy scandal, everything now converges as a part of ESG issues and is screaming out loud for our immediate attention. Especially as an investment analyst trying to understand the overall mission of the company and how they plan to achieve their goals, Sustainable finance plays a key role in shaping the future of various companies.

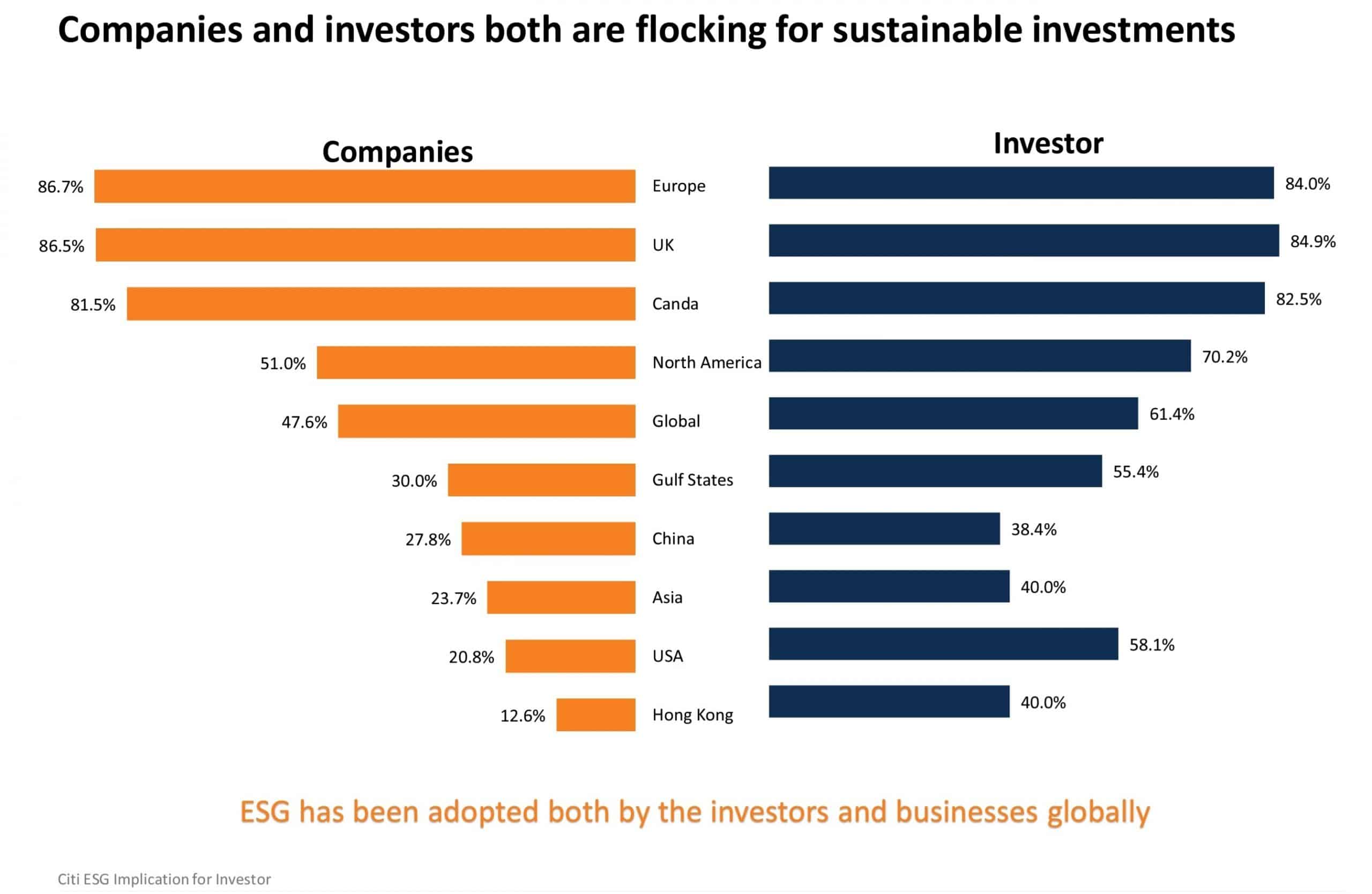

ESG in today’s landscape is hard to overlook- be it an investor, company, or a regulator; precisely, any individual or institution. In order to make World a better place to live in, we need to put things into perspective and it starts from what we build and where we invest in. 17 Sustainable development goals (SDGs) drafted by the UN is very comprehensive to apprehend the importance of ESG in today’s scenario.

Subsequently, the narrative changed from the cusp of being a ‘better and ethical investing opportunity’ to becoming an important ‘risk-reducing metric’ in the construction of a portfolio.

How is it implemented?

Money is obviously flowing into ESG themed funds. As of 2020, the overall money put into ESG investments was close to US$40 trillion. But, how are they managed when some of the ESG issues aren’t even material and obvious to the naked eyes? How do we differentiate between companies that are actually making efforts to contribute to SDGs and those that are greenwashing just to stay away from regulatory oversight?

It starts from understanding what is given more importance by a company – E or S or G or a combination of any two or all three. As an automobile company, they could strive towards manufacturing vehicles that have minimal energy consumption or look for alternative energy resources. Ola electric is one of the recent examples for E. Diversity and inclusion is a commonly discussed topic under G for companies to ensure that there is equal importance given to women’s growth in leadership roles, giving equal opportunities to various ethnic groups including those coming from minority groups, etc.. Clear mission statements are important for companies as much as how redefined investment purposes are for investors, in marching towards welcoming ESG together.

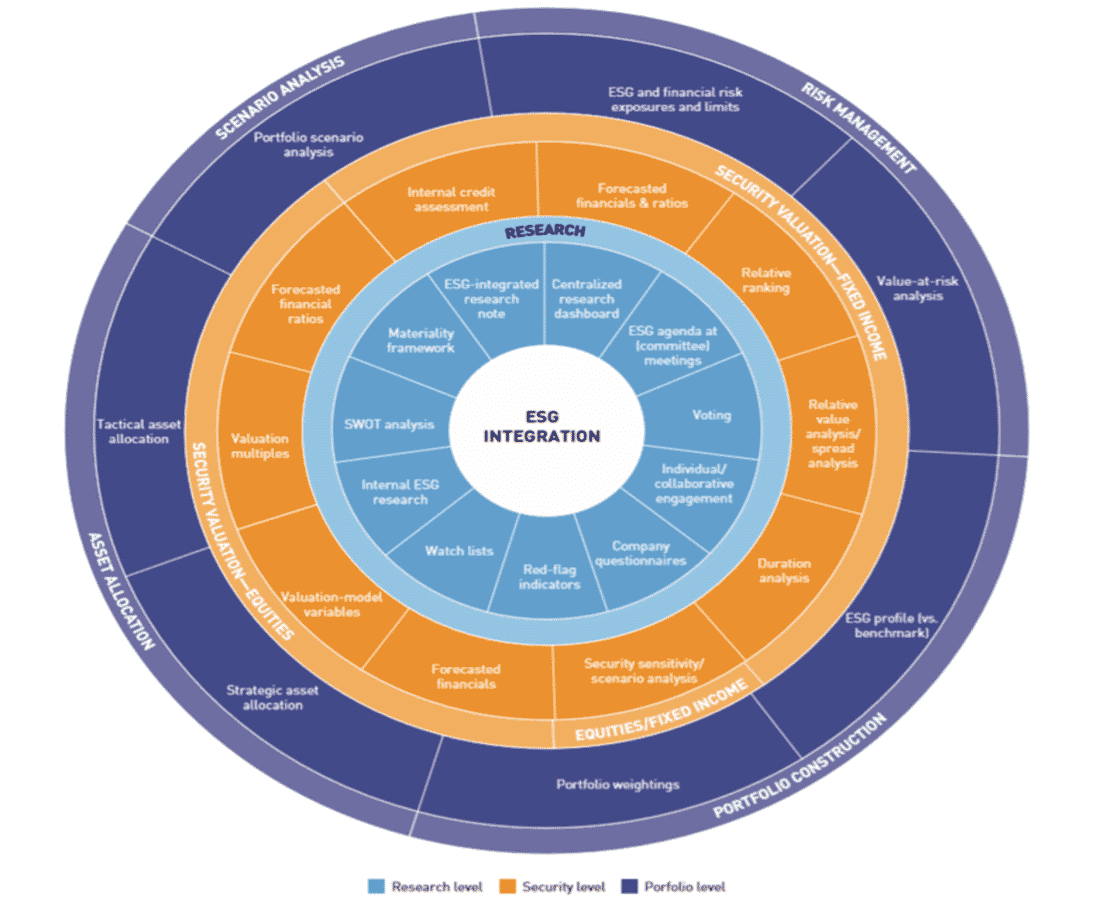

As a PM managing your portfolio, a holistic ESG analysis is usually carried throughout fundamental analysis in a way of integrating in the portfolio. There are various categories to- and facets of- ESG investing and the investors have options to choose between various RI products that are available in the market.

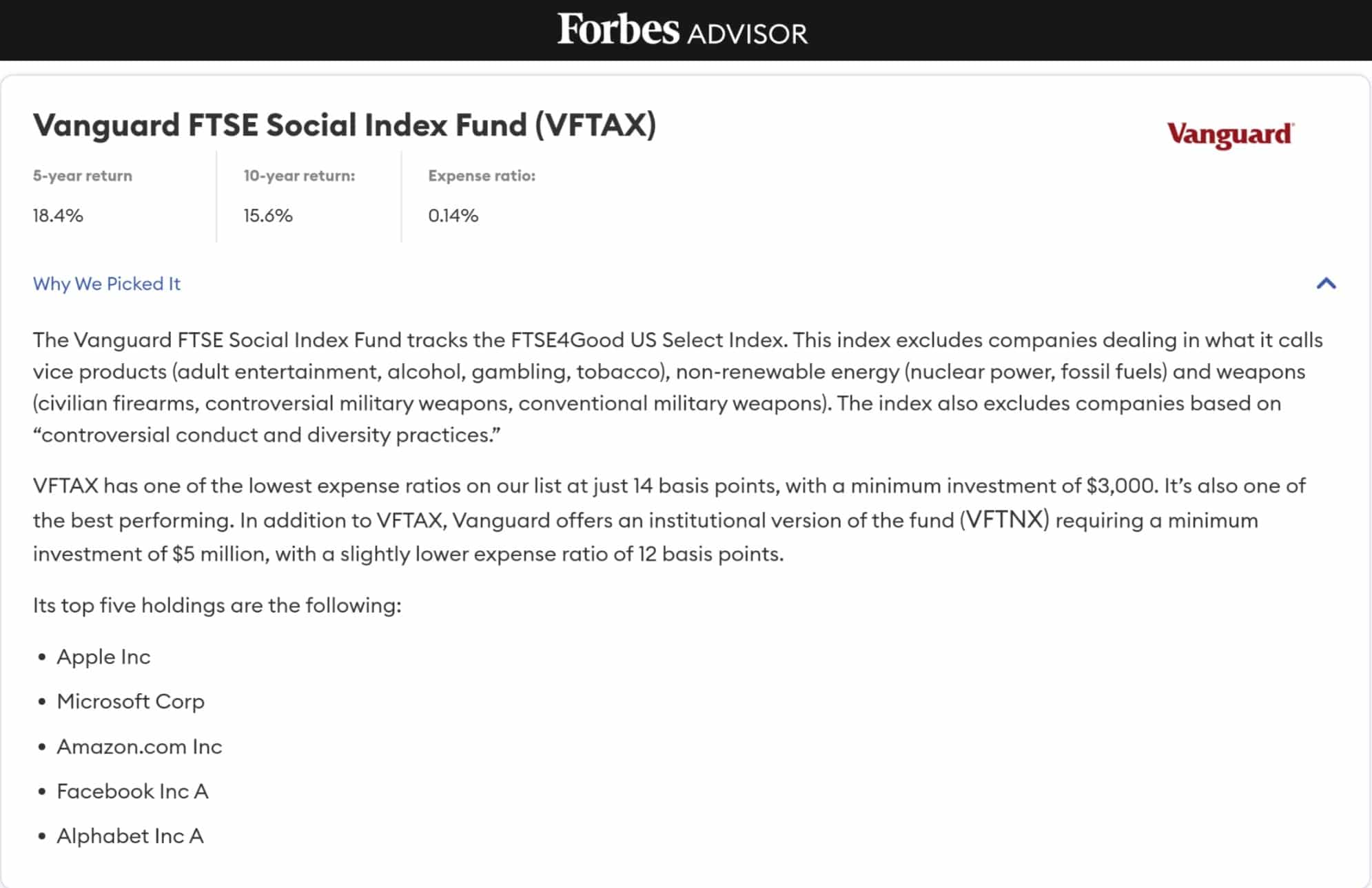

There are funds that are ESG focused which only invests in companies after following certain ESG screening and scoring methodologies. There are also funds that are fully or partially integrated by ESG factors. Either ways, the PM can draft ESG policy for various asset classes which may speak elaborately about negative exclusions, active engagement, stewardship, impact investing techniques, proxy voting, engagement practices, etc.. in line with firm-wide practices.

At this time, there are very few asset managers who conduct ESG practices to such a granular level and most of them have standard ESG policies at firm level that they apply across asset classes with portfolios tilted depending on the investment policy of respective funds.

Various facets of ESG investing

Negative exclusions

A certain companies or sectors may be excluded in the portfolio due to controversial business activities or practices. It can even be a product or business that you think may be harmful for the economy in some way.

A company may be found continuously exploiting the minority shareholders and their interests by only focusing on the ultimate benefits for the board and returns on their investments.

Some of the companies/common topics that most Fund managers have strong opinions against are Tobacco, Controversial weapons, Gambling and Carbon footprint. These are because of the general adverse sentiment of investors against companies that are manufacturing or closely related to them. As a result, some of these may be excluded as a part of the screening process. Analysts may have thousands of securities in their potential buy/sell list that could have made the cut in terms of profitability and other financial metrics but may only shortlist hundreds of them after the ESG screening process.

There is a whole different hypothesis to not avoid these ‘sin stocks/securities’ because these issues are still not fully material due to insufficient ESG data and can not be accounted for accurate measurable metrics. Beyond that, we are still bridging the gap between financial performance and ESG performance in order to build a more convincing argument.

Active engagement & Stewardship

Fund managers have access to the decision-makers of the company and they use it to make some changes to Company’s corporate governance or contribute to the environment by optimal use of resources and many more. They do these by attending company meetings with the board and senior executives of the company, in a way helping them to make effective decisions by keeping certain ESG issues in mind.

Fund managers also take part in voting and help management create voting proposals and to arrive at final resolutions as a way forward for the firm.

A better investment outcome can be achieved by backing companies that have improving ESG momentum, as opposed to purely focusing on companies who are already there. Most fund managers believe that Engagement and dialogue tend to generate better results than exclusion and divestment.

Earlier this year, the Greensill and Archegos Capital debacles for Credit Suisse, Nomura and others resulted in a significant scrutiny and criticism for the Social and Governance oversight in the Financial Sector, and implied a potential fallout for regulation as well as risk management in the banking industry. This caused Credit Suisse to back down from their relationship with these firms after close dialogues and understanding of what went south on their respective sides. Many industrialists questioned the integrity of these banks as they also characterize themselves as one of the torchbearers of Responsible investing.

ESG integration

Analysts integrate ESG factors systematically throughout the traditional financial analysis with the help of in-house, proprietary ESG analysis and external ESG data vendors and rating agencies as well.

There are various signatories and projects pertaining to ESG that firms these days have started associating themselves with to build the credibility and some sort of backing for implementing ESG in their investment portfolio. Sustainalytics is one of the famous ESG data providers. Climate action 100+ is one of the renowned ESG initiatives to combat greenhouse gas emissions by making companies take responsible actions towards climate change by helping them achieve the net zero emissions goal by 2050.

There are many other organizations like SASB, UNPRI, TCFD, etc.. that provide assessments on various companies and asset managers which will help you make better ESG-oriented decisions in choosing a company to invest in or an asset manager to help you make that scholarly decision for you.

ESG integration frameworks vary from one fundhouse to another because there is no sufficient ESG data on all the companies and it is challenging to assess ESG investments in public markets at all times. It is not like ESG is embodied in GDP to have standardized ESG metrics across all RI Products but we sure are shifting towards creating a decorum by starting to treat ESG Quant investing and Sustainable finance seriously.

Impact investing

These are targeted investments typically addressing social and environmental factors in line with the UN SDGs. The impact investment market is growing rapidly and provides capital to address some of the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education.

Some of the ESG metrics to look at, as an investor

- Depending on the type of industry that a company is in, you can compare how consciously and responsibly they are utilising the resources. You can also refer to Global Sustainability Reporting Standards for some reference.

- It is always important to understand if the company is treating its own employees fairly. Factors like age or gender discrimation, wage cap, diversity and inclusion are useful metrics. There have been few indexes introduced in the market to gauge the same. For example, Global Equal Opportunities Select Index.

- Companies policies that are in place to promote and inculcate ethical behavior while also appropriately penalizing for illicit or unethical actions. CFA institute’s Code of ethics is a great example for standard ethical and professional conduct that are required to be followed by investment professionals across the Investment industry.

- It is equally important for companies to achieve ESG goals than just greenwashing them under the pretext of being a responsible contributor to the economy. The company’s ESG reports should disclose information like their active participation or engagement in ESG issues and what was achieved through that discussion.

- Companies must produce comprehensive reports that list down measurable outcomes from their ESG related initiatives rather than beating around the bush with verbose, lengthy documents.

Further, there are various market indexes and organisations that provide reports that are resourceful to make informed decisions. All these also show a company’s real time involvement and frequent engagement with issues related to ESG which will create a natural hedge in attracting investors.

Now, why should an ESG fund make it to your portfolio?

We have discussed at length about various concepts within ESG and the rationale behind the rise of this industry in recent years. The popular belief is that ESG funds tend to pay off very well in the long run and helps bring out plausible reasons behind market inefficiencies and anomalies that cause mispricing of securities.

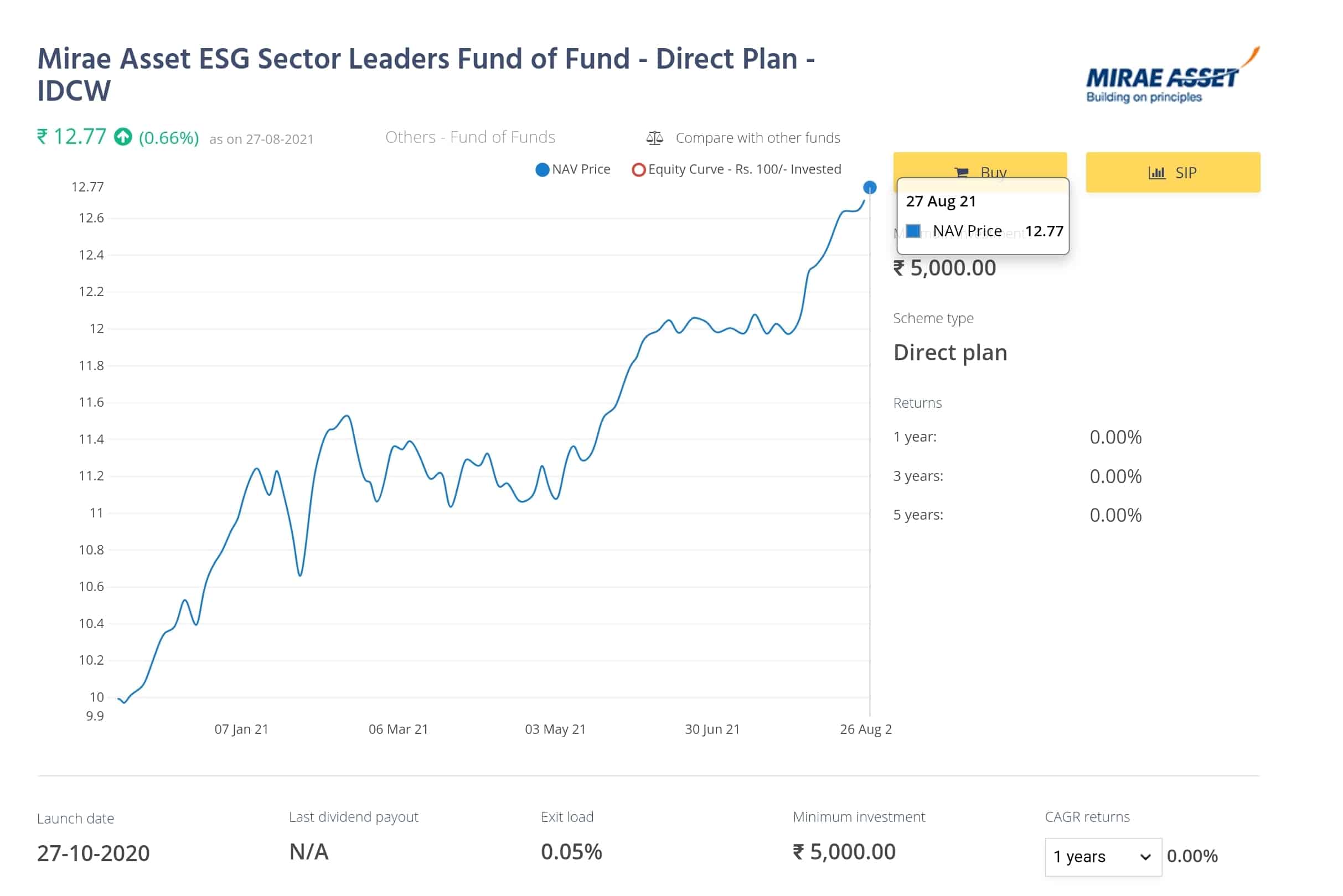

The snapshot above is from Mirae Asset ESG Sector Leaders Fund of Funds’ Investment report which is one of the interesting ESG products in my watchlist. This Fund is one of the first passive ESG funds launched in India and tracks the Nifty100 ESG Sector Leaders Index.

Although there is limited track record for ESG in the Indian stock market, this one sure is worth keeping an eye out for if you plan on allocating some money towards ESG.

Companies that pay attention to ESG and make reasonable shifts to some processes within the firm tend to also avoid tail risk events and keep all the stakeholders involved generally happy. A simple logical surmise is that, ‘What is keeping anyone from doing their job if everyone is happy with what they make, satisfied with what they do and appropriately engaged at what is important for the wider community?’ Though these are seemingly immeasurable metrics at this point, would it be hysterical to believe that it will form the core of opportunity management, corporate reputation, risk reduction and culture and intrinsic value of the companies, and may become most appealing to invest in?

If you have made it this far, I would love to know your views on this topic too!